What is a credit report?

Why are credit reports important?

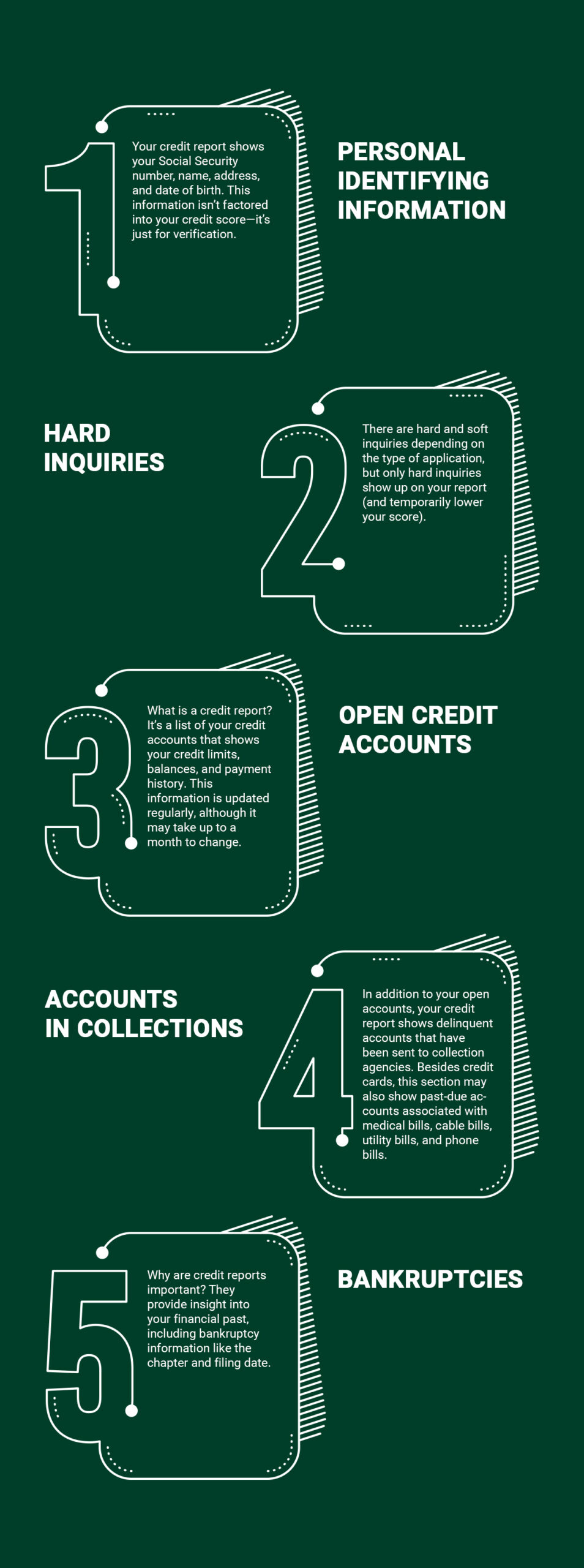

What is on a credit report?

In this blog post, we’ll provide answers to some of the most common questions we get about credit reports. Understanding the ins and outs of credit reports empowers you to manage your finances more effectively so you can get favorable terms for loans, credit cards, mortgages, and other financial endeavors.

How Does Credit Reporting Work?

There are three nationwide credit bureaus: TransUnion, Experian, and Equifax. These credit reporting agencies collect data about your credit cards, loans, bankruptcies, and any other relevant information about your financial standing.

So, what is a credit report? It’s simply an overview of all of your accounts and their current standing. It also includes a corresponding credit score ranging from poor to excellent.

Why are credit reports important? Creditors and lenders view your credit report and score to determine your borrowing eligibility and/or loan terms. Better scores mean better rates.

What Information Does Your Credit Report Show?

What is a Credit Report? Contact Us to Learn More

What is on a credit report, and how do you view yours? It’s easy to find this information online. Federal law allows you to obtain a free credit report once every year from each of the three credit bureaus. Some credit card companies and third-party services also offer regular updates to your credit report and score. You can even take steps to improve your credit score if it’s poor.

If you have any questions, please feel free to contact us for more information on how your credit report affects the loan process. Apply for a loan now!